Christie’s, the historical auction house and a pioneer in the art world made history a few weeks ago by auctioning off artwork for a record US$69 million – making it one of the most expensive works ever sold. The piece entitled “The first 5000 days” created by the contemporary artist Beeple cannot be hung on a wall or taken home. This is an artwork ‘minted’ or created digitally on a token in the form of an NFT.

Jack Dorsey also made headlines too earlier this month, by auctioning off his first-ever tweet as an NFT using the popular website Cent.co. The winning bid was US$2.9 million. Canadian musician, Grimes, sold 10 pieces of digital artwork at close to US$6 million and CryptoPunk’s collectable digital avatars have been in high demand, fetching as much as US$1 million apiece. In the past month, people have spent over $1 billion on digital assets, according to data posted on CryptoSlam.

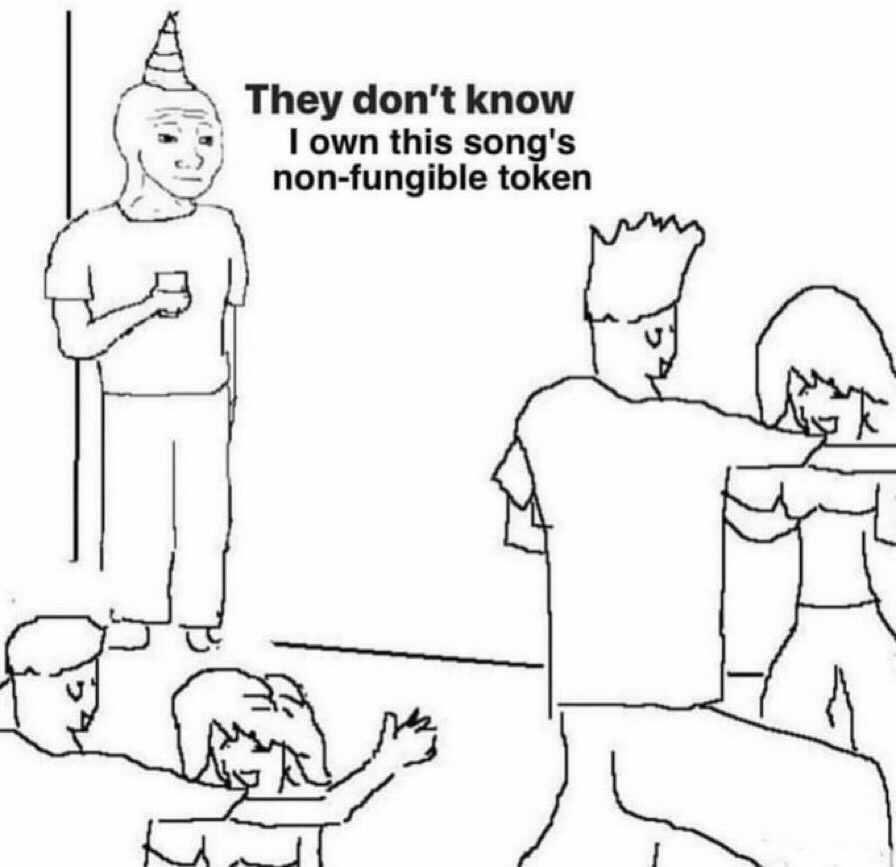

These eye-watering valuations are proof that crypto assets are very real – and in some cases – very profitable. NFTs are not restricted to artwork alone. They include non-tangible assets such as digital tradable cards, sports clips, video game items, code, mathematical equations, algorithms, text, tweets, artwork, photography, logos, audio-visual media, songs, presentations, spreadsheets, zero-day hacks, and much more. If the hype sounds familiar; it may be because it is reminiscent of the cryptocurrency boom that erupted several years ago.

So, what is an NFT anyway?

NFTs or Non-Fungible Tokens are original items created in a digital format and tokenized using blockchain protocols, such as Ethereum’s ERC-721 or ERC-1155 contract standards. These tokens include the creator’s digital signature, imprinted for proof of authenticity, and available for anyone to verify. Most importantly, they are fungible, meaning each token has unique characteristics (or metadata) that make it a one of a kind and, unlike bitcoins or fiat currency, cannot be replaced by another piece of the same value.

Hurry! Limited Editions only!

The initial excitement has already given way to scepticism. Firstly, the trend risks becoming a casualty of its own success. As with other crypto hypes of recent times, we are seeing an explosion of NFT content. The profitability of the scheme has enticed many to rush out limited edition material with the hopes of hitting the jackpot. This will inevitably lead to a decrease in quality and affect one of the most appealing features of NFTs, namely scarcity. There are no basic requirements or barriers to entry for creators and therefore no control over the supply or quality of NFTs. Speculators too are anxiously outbidding each other for record sums, without understanding the true value of their purchases – in the hopes of turning them over for a profit. Many admit to not being a fan of the artwork or music they purchase or having agendas, such as promoting NFTs and cryptocurrencies in general. Therefore, demand is not a reliable factor either.

Another crypto roller coaster ride?

Again, similar to the cryptocurrency boom; there are bound to be winners and losers. Just as we are witnessing big payouts, we will witness subsequent windfall losses. The current prices of NFTs are fuelled by record-breaking low-interest rates, a generational mistrust in gold and the US dollar, and an increase in the price of cryptocurrencies such as Bitcoin and Ethereum. Some might argue that continuing economic growth over the last decade and the exponential growth in the price of Bitcoin has turned many younger investors into risk-seeking junkies. Others see NFTs as a continuation of the cryptocurrency and blockchain revolution, and just the tip of the iceberg in the applications of blockchain technology.

What is certain though is that some NFTs will fare better than others. The knowledge of which NFTs will be profitable in the long run, or making sense of the volatility in the market is no different than looking in the proverbial crystal ball. Regardless, certain stakeholders will play key roles in determining whether NFTs become extinct or transform into a widely accepted, wealth-generating asset class.

The promise of NFTs

NFTs are only as valuable as the communities that support and recognise them. Similar to the purchase of any traditional asset, a winning NFT will already have a dedicated and persistent following. For example, Beeple, whose work you might remember got sold for $69 million – has been making artwork every single day for the last 13 years, as well as posting it online and making it available for free. He offers many assets and working files for free, for others to learn from. He has done numerous interviews and art workshops in the 3D art community for years and has a following of 1.7 million followers on Instagram alone (which is not to say Beeple does not have his detractors.)

Sometimes, it’s not an individual but a genre. Sports fans have existed forever. The trade-in sports memorabilia and collectibles will continue for the foreseeable future. Similarly, fantasy gamers or music fans of certain genres will always value collectibles, whether tangible or not, for many generations to come. NBA is one of the first major sports organisation to experiment with this new revenue model but will certainly not be the last.

On the other hand, those who invest in NFTs linked to viral celebrities and incidental influencers will do well to remember the short-term collective memories of our species. For example, Elon Musk has taken several digs at NFT investors.

The market in NFTs will see tremendous growth potential once the early adopters give way to more seasoned veterans, critics, and experts, to lend more credibility and direction to this new asset class.

Caveat Emptor or caveat venditor?

A functioning legal system detects loopholes in the use of new technology and patches them quickly. It understands the need for oversight in a market that is ripe with fraud and manipulation.

In hindsight, regulators and consumer protection agencies took too long to get involved in containing the ICO bubble several years ago; most likely because they did not understand the technology or underestimated how quickly it would catch on with mainstream investors. When they came around to it; crypto winter had already begun to set in and the losses too large to ignore.

This time around, regulators may be more knowledgeable and better prepared to rescue disgruntled buyers and investors. The challenge though is that since NFTs are fungible and serve a diverse range of use case scenarios, they are difficult to classify as either a security or an asset and that classification may differ from one NFT to another.

Regulating the market

Those who truly believe in the transformational powers of blockchain technology should welcome scrutiny by the government. There’s a growing concern regarding price manipulation of crypto assets through NFTs. Metakoven, or Vignesh Sundaresan, the individual behind the winning bid for Beeple’s artwork, is also the CEO of Metapurse and previously Coins-e, a failed cryptocurrency. Journalists have dug into his past and question his integrity.

In addition to protecting investors from financial losses; other challenges include keeping crime out of the market. There is nothing stopping NFTs from being minted by individuals and countries on watchlists, and proceeds of the sale going towards funding criminal enterprise. The trade and exchange of tokens has come a long way since the heydays of crypto, and transaction monitoring and KYC protocols are set in place – however criminal and terrorist organisations are not given up on its potential.

Crypto crimes

The biggest challenge comes in protecting legal ownership outside the blockchain. Although the purchase of tokens is supposed to be safe by design (they are secure, encrypted, irreversible, public, and decentralized) cryptocurrencies and tokens are frequently stolen. Common methods include Spoofing, creating false websites to obtain login credentials and private keys, as well as dark web ploys such as phishing and scams to get investors to part with their crypto. The question of ownership might also be contested in cases of inheritance, or in business dealings where NFTs are used as collateral assets or payments.

Making NFTs work: the case for taxation and copyright protection

Most governments today welcome the opportunity to legitimise a new technology if it creates a reliable tax opportunity. Incorporating a tax calculation and management system into smart contracts for crypto asset transfers and investment gains is a small price to pay for the acceptance of NFTs in to mainstream, as well as regulating the market. This will massively boost investor confidence, lend credibility to the industry, and generate a level of interest similar to the Cannabis industry. The good news is that the comprehensive legal framework which already exists for most asset classes can also be applied here, in addition to the numerous crypto regulations that were created over the last few years. For the most part, tax revenue will go towards policing and the enforcement of property ownership.

Many US-based retail investors may be shocked to learn that they will owe capital gain taxes – not only for the sale of NFTs but also when purchasing NFTs using cryptocurrencies such as Bitcoins or Ethereum – because the IRS deems the transaction a sale and purchase of assets.

HAHAHAHAHA — accurate quote. 🤷 https://t.co/hE2rHAJ79e

— beeple (@beeple) March 17, 2021

NFTs and Intellectual Property rights

Authorship and ownership in copyright laws, as well as its enforcement, is one of the major hurdles in transforming any industry to its digital equivalent. NFTs will only be valuable if the owners can legitimately profit from its ownership through royalty payments.

Currently, as it stands, when someone purchases an NFT tied to a piece of content, they are not automatically granted the rights to the underlying intellectual property. To take pictures of, display, merchandise or resell images of the property for commercial use, the owner of the NFT has to receive exclusive permission with evidence in the form of a contract from the seller. Absent this, the new owner has only legally purchased the rights to the underlying token because current laws do not make special accommodations for the transfer of NFTs. In reality, most terms of sale miss out on the distinction or limit the scope of the transfer to personal and non-commercial use.

Even if such a contract was put in place, there is no reliable system in place to monitor the usage of images, audios, or videos; and to monetise from its distribution. Digital copies of NFTs can be consumed without permission today. The digital media industry made huge compromises towards legitimising the use of digital media amongst younger users (particularly millennials – many of whom still remember Napster, BitTorrent, and illegal file-sharing) by allowing subscription-based services such as Spotify and Netflix. A similar system could be of value in the NFT market.

More care needs to be put in place when the NFT is an intellectual property such as a code, an algorithm, or a mathematical equation with the capacity to spur innovation or help create new technology.

NFT Rising Stars

A majority of NFTs traded to date have been works of art, music or visual clips. Many of the proceeds of sales have been contributed to charity or purchased to share with the public. The industry sits on the shoulders of a few charitable, yet savvy giants.

For the wider public to take interest in these instruments, other forms of NFTs need to be widely available in the market. These are:

- NFTs backed by real-world tangible assets, such as stamp or gold.

- NFTs backed by certain benefits such as an exclusive membership or a share in revenue from advertisement or the display of the asset.

- NFTs that provide a one-time benefit such as meeting a celebrity or attending an event. The NFT can then be imprinted with a signature or memory of the event.

In conclusion

For NFTs to truly reach its potential as a widely accepted and valuable asset class, the focus needs to shift back to the organic growth of communities. Every asset, specifically the more artistic and intrinsic NFTs are given value by the communities that create and covet them, and that is the true future of NFTs. Government and regulators need to be given their due in the form of taxes, in return for recognition, regulations, (such as intellectual property, ownership and copyright laws) as well as better policing.

Ultimately, the buyer should conduct their own due diligence as to the owners of the NFT and any potential link to money laundering. Buyers are also responsible for detailing the scope of the transfer of ownership by signing a contract outside the blockchain. Finally, creative art might be a niche market for most buyers and a risky purchase if investors don’t understand the true monetary value of the art. Other forms of assets and benefits underlying NFTs might prove more popular, such as those that provide more tangible benefits.

However volatile the next few years may be for the NFT market; the hope is that once the dust settles, we are able to see the real from the make-believe.